Let Us Make Financing the Easiest Part of Your Move

You’ve found the right property. Now make it your home with the right financing- Make the home loan the easiest part of your move

- Avoid common mistakes when financing a home purchase

- Have an expert guide on your side from pre- approval to close (and beyond)

Buying a home can be complicated and it can be hard to know where to start

- *Not having a full pre approval means your offer is not likely to be considered

- *Sorting through all the contradicting information is overwhelming

- *You are not generic and neither is your transaction. Trusting your home purchase to a faceless website could leave you stranded and missing out on the best options for you and your family.

There are many ways financing a home purchase can go wrong - make sure that's not you!

Here’s how we help make your home buying process easier

-

We anticipate issues and deal with them upfront.

Getting a transaction done properly is more complex than it should be so choosing who to work with becomes important to a smooth, stress free closing. -

And we call the listing agent on your behalf.

A full loan approval completed in advance will let the seller know you are serious and make it happen!

-

You get a loan strategy tailored to your needs that will make your home affordable.

There are lots of companies that can do a home loan. At Signet Mortgage, our team will help you do it right and leave you with peace of mind. -

It is the lowest cost over the term of your loan that is the key.

The lowest rate is seldom the best choice. Finding a balance between cost and rate is the difference between a good and bad loan.

Almost all of our business comes from our happy clients and partner referrals.

We will work like crazy so we can add you to the long list of happy clients:

Buying a home is stressful enough without having to worry about the financing

You likely found Signet Mortgage because a family member, friend or advisor suggested you take a look. Client referrals are our “bread and butter” and this has been the case for almost 20 years.

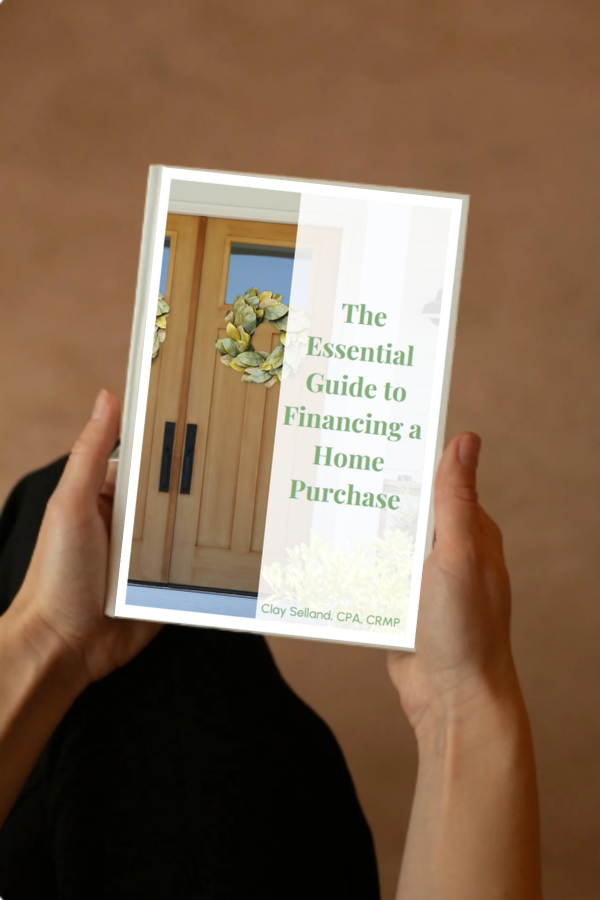

I am a CPA and have worked in finance my whole career, so I have a unique perspective that incorporates finance, taxes and life through retirement.

Schedule a ConversationWhat Our Clients Have to Say

"My wife Teresa and I have been very happy in our dealings with Clive Selland of Signet Mortgage. Clive held our hands and guided through the complexities of the Reverse Mortgage procedures., the result : our current confident and secure home situation. We have no hesitation in firmly recommending his company."

—Edmund S., July 22, 2024

We help you find the right loan

Fixed, Adjustable, Hybrid ARM's

-

Low down payment options

- * Conventional loans with as little as 3% down payment

- * FHA loans with 3.5% down payment

- * VA loans with $0 down (awesome!) Loans options for your situation

- * First time home buyers

- * Investment properties

- * Purchase before selling

- * Transactions with "wrinkles" (we make it happen)

-

Schedule a conversation

Clay will review what you would like to accomplish, share choices and opportunities how to get to where you want to go. -

Move forward with confidence

and Shop like a “boss”

Share information, get fully Pre-Approved, and move forward with confidence. Along the way work together to get your offer accepted, secure the terms of your new loan, while communicating at all stages and avoiding surprises. -

Close on your new home and relax

Put the financing of your home in the rear view mirror secure in the knowledge you found the right guide to make it happen for you. Live well and enjoy your home!

What happens when you choose to work with Signet Mortgage

At Signet we know it can be hard to feel confident that your finances can handle all the ups and downs ahead. With personalized attention and guidance, we help our clients stop feeling stressed and anxious about their biggest financial decisions and instead accomplish more than they dreamed of.

We get your deal done, no drama and on time.- Sending a client off to find their own mortgage loan means you miss the opportunity to position yourself as a trusted resource.

- Pre approval letter has "meat" and makes you look good

- We call the listing agent and share how well qualified you are

Make the home loan the easiest part of your move

Make the home loan the easiest part of your move

Avoid common mistakes when financing a home purchase

Avoid common mistakes when financing a home purchase

Have an expert guide on your side from pre- approval to close (and beyond)

Have an expert guide on your side from pre- approval to close (and beyond)

Schedule a conversation

Schedule a conversation Move forward with confidence

Move forward with confidence Close on your new home and relax

Close on your new home and relax