Get Home Equity to Work for You

A refinance done well can add security and confidence and help you build housing wealth-

Reduce your interest rate, pay your loan balance down faster

Reduce your interest rate, pay your loan balance down faster

-

Lower your monthly payments, improve your cash flow

Lower your monthly payments, improve your cash flow

-

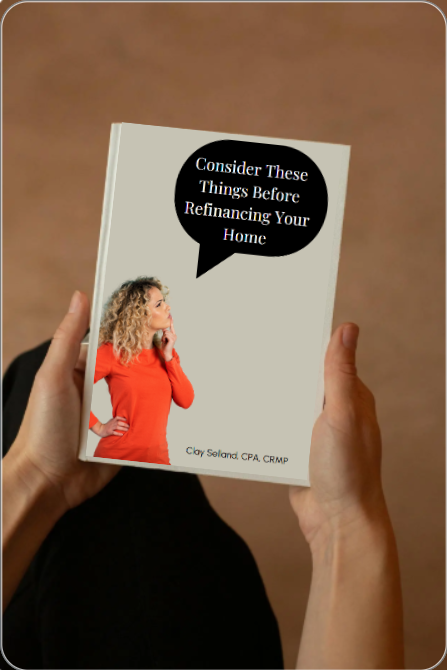

Have an expert guide outline possibilities just for you

Have an expert guide outline possibilities just for you

Refinancing a home can be smart or maybe not so smart. Knowing the difference is key to building equity.

-

The "bank" or your current lender is not necessarily the best choice.

Often less competitive because they are "the bank" with a lot of overhead and figure they have your transaction “in the bag”. -

The lowest rate is seldom the best choice.

Failing to properly factor in the costs of a transaction and your expected timeline will result in a bad choice for your refinance. -

Mortgage choices are overwhelming and it’s easy to make a mistake.

With no shortage of companies that can do a home loan, it's a challenge finding someone you can trust, and who will guide you.

There are lots of moving parts when financing a home or investment. We will guide you to a solution that meets your short and long term goals.

We make your refinancing process easy

- Move forward feeling confident and secure

- Access more options to fit your needs

- Refinancing can help you manage your finances with ease

- Reduce your monthly payments

- Simplify the process and know you’re doing it right

We help you make sure refinancing is the right choice for you - in the short and the long term

- There are many reasons refinancing may make sense for your situation. But it can be hard to navigate the process with confidence, especially as the lowest rate is seldom the best choice, making it confusing to know what to do.

- You have found a guide that you can trust to help you through the process. I will handle your transaction with care and make sure your decision aligns with your short and long-term goals.

- I have worked for 20 years in lending, and another 20 years as a CPA and in corporate finance so I have a unique perspective that incorporates life, finances, taxes and a genuine interest in helping you safeguard your future.

What Our Clients Have to Say

"Clay has helped me purchase and refinance my last two homes. He and his staff are very knowledgeable and a pleasure to work with. I have recommended Signet Mortgage to several friends and family and will continue to call them first for anything related to my home mortgage."—David K., July 11, 2023

You have options - Refinance for any purpose

- Remodel, Consolidate Debt, Lower rate / payments

- Conventional loans with as little as 3% down

- FHA loans with 3.5% down

- 100% financing with VA loan

- Loans options for First time home buyers

- Investment properties

- Difficult financial situations

Get your refinance done and

done without drama

-

Schedule a conversation

Schedule a conversation

Clay will review your particular situation and share choices and opportunities to meet your objective. -

Move forward with confidence

Move forward with confidence

Work together to secure the terms of your new loan, communicating at all stages and avoiding surprises or drama. -

Choose your best option and relax

Choose your best option and relax

Put your refinance in the rear view mirror, secure in the knowledge you found the right guide to make it happen.

What happens when you choose to work with Signet

At Signet Mortgage we know it can be hard to feel confident that your finances can handle all the ups and downs ahead. With personalized attention and guidance, we help our clients stop feeling stressed and anxious about their biggest financial decisions and instead accomplish more than they dreamed of.